Fixed Price vs Time and Material

No, this is not going to be complete guide what type of offer (and contract as results) select for the project and customer. It will not even be a guide at all. Decision on offer and contract type is in many cases is given and determined by specific business, solution, market situation. And only sometimes we can have the freedom to decide.

This Snack is to more to consolidate some information on what can drive different offer types: Fixed Price and Time and Material.

Also, there are multiple types of Fixed Prices and Time and Material offers. But we will not discuss differences and nuances here. We simply take those two as they are - as billing types.

Selecting one over another may have good reasons but also consequences.

Below are some examples (not all) of driving factors why we have one type over another.

Risk Perspective

When we ask about why we select one project type over another, almost guaranteed any business development professional will first point on risk.

It is a common opinion that Fixed Price offers (and its delivery) transfers more risk on Supplier than Customer.

And vice versa Time and Material puts more risk on Customer over Supplier.

And in principle we can agree.

From the Supplier perspective, a Fixed Price offer means probably “scope and responsibility” to deliver, while Time and Material is more “skills and capacity”.

From Customer perspective Fixed Price means we expect more “deliverables/results” as output for the price. While Time and Material is more getting “service”, but the final product is not guaranteed.

I many times questioned this simplification, stating that offer type is just billing type and from risk perspective it really mitigates Supplier Cash Flow only.

But the fact is, many times the Risk factor is a driver of selecting offer type, on both sides of a transaction – and it seems to be quite opposite perspective on each, as risk is important to both sides.

Time to Market Perspective

Fixed Price offers assumes there is scope defined. And the definition of scope takes time and money.

This “Time and Money” can be called here Time to Market factor.

Let’s assume the following typical scenario – specifically for large or governmental organizations procuring projects.

Going backward, in order to start the project the specific Fixed Price contract has to be signed with Supplier. This take contract negotiations. Before this the Supplier has to be selected. This takes a Procurement process of selection probably with many suppliers to enter. For suppliers to enter it takes time to understand requirements and scope definition. The scope definition needs to be prepared before by the Customer. And so on.

There is a lot of steps to go. In extreme cases it can take months and even years. Surely there smaller the project less time to prepare it takes, but there is always Time to Market factor specifically for Fixed Price offers.

On the other side for Time and Material offer it is much less to go. Even we have multiple Suppliers involved it is less time needed from Supplier to offer and from Customer to procure it.

In Time and Material focus of discussion is different. Skills, bandwidth, and cost rates.

The last may be very uncomfortable for the Supplier.

From my experience Time and Material is very effective to Customer as it can be procured fast and probably cheapest (based on cost rates). The only prerequisite here is Customer has to trust Supplier enough to go this way. This trust is gained from some solid track of successful delivery in the past, often based on a Fixed Price offers.

Value Perspective

Value is probably the most interesting driver, but least considered.

Specifically taking Supplier seat. To be very open in my opinion Fixed Price offers (Projects) have much bigger value over Time and Materials. Let us look at this in more detail.

"Fixed Price offers undoubtedly are more Value overall, unless Time to Market is a key"

First of all Fixed Price Offer theoretically should generate a higher price for the Supplier.

Only if we take cost-based pricing and the same scope and resources, naturally the price will be driven by workload cost and risk and margin. In comparison to Time and Material which is a cost rate and margin on rate.

Risk itself will drive a higher price. Also offering one price (instead of rate card) is harder for Customers to question than cost rates of resources.

But Fixed Price offers have another quality. Behind the Fixed Price offer is scope and probably business outcome. If well sold Business Outcome, a potential price can be disconnected from cost, which makes it very attractive for the Supplier.

I dare to say if a discussion is on this level between Supplier and Customer this can be very attractive to Customer as well.

This is something one can never archive with Time and Material offer.

Delivery Perspective

The last driver for selecting the offer type is the capacity to deliver. Fixed Price offers, and following projects require probably more mature practice for delivery.

It covers everything from Scope management, Contract Management, Project Management, etc.

Not everybody has methodologies and competence. But if one has it drives Supplier to higher grade partner for Customer.

Old anecdote says If You deliver Bodies (Time and Material), You will be treated as You deliver Bodies.

Following this if You deliver scope (Business Outcome) You will be treated the same way.

Conclusion

We do not always have the luxury of selecting an offer type between Fixed Price and Time Materials. Many times, it is dependents on many factors.

Overall, I strongly believe unless Time to Market is a factor or cash flow is a priority, Fixed Price always is a better method.

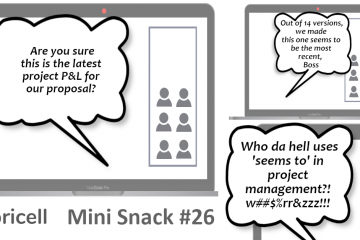

But in both cases offer cost and price must be well prepared and calculated. Including Risk buffer.

Both methods require attention and tools to be used for price calculation.