(Some) Professional Services Business KPIs

Those who manage professional services business know by hart key KPIs to run the show.

One of the main and most critical is Utilization and Billability. In principle, it measures how much time can be 'sold' to the client (billability) or used to create value (utilization).

Next is Under absorption or Over absorption. It measures the real execution of assumed utilization and planned cost rate.

Also operating Gross Margin practice considering full stream profit and loss is one of the keys.

There is also Customer Satisfaction score and many more known KPI's

All those KPIs are interrelated each over. And they are subject to careful planning at the beginning of the fiscal period (mostly year). Right execution and tight management allow professional services companies to generate profit.

But are those all KPIs, which matter?

Presales vs Billability

Part of the game of utilization is split between presales and billability. Depending on assumptions this can drive higher or lower cost rates.

On the other hand, cost rates are critical as they drive t price. Naturally, companies would like to see as low- as possible cost rates. This would generate better margins of the services.

Following this, the lowest cost rate can be archived when we plan truly little not billable time for resources.

But here is a catch. None of the companies can afford NOT to have presales cost (not billable) as this drive new business.

Balancing between the right planning of presales time and billable time is critical.

Then the very next critical area is the management of presales itself. Many companies struggle here. And I am not talking about monitoring Presales budget left once it is defined at the beginning.

It is to understand how effectively we spend Presales budget, now and here. In a sense of qualified rather quantified measures.

Effectiveness of Presales

Ok. Let me ask a couple of questions, which may not be easy to answer at first but maybe critical to understand qualitative effectiveness of presales work.

- How many offers we produced last month?

- What is the size (value) of the offers we produced last month?

- How many offers were accepted by customers last month?

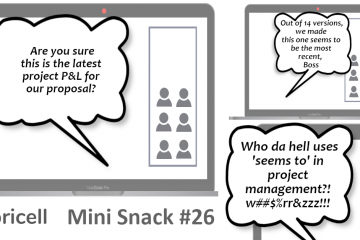

- What is the number of draft versions of the offer until it is sent to the customer?

"The very next critical area is understanding how effectively we spend presales budget. In a sense of qualified rather quantified measures"

There are more questions like above. We can also ask for a quarter or year to date.

The main point is this information is often not very visible to companies. And managing partners of CFOs would be interested in those details.

Observing that information will allow us to take measures to improve the effectiveness of presales. Also, make an informed decision about where to spend resources.

Planned vs Real Sales Profit (Marge)

Here is a second set of questions, which theoretical may be easy to answer but in practice, it is not.

Let me first bring the scenario.

With experienced salesperson, the process of agreeing a price with customer looks often (not always) like this.

At the early stage of proposing a selling person is getting an understanding of the expected budget.

The offer price is calculated to fit the budget but also to reach company goals (minimum margin).

During negotiations, the customer expects to have a price lower. Unless scope does not change, either there is some uplift planned for this (rare case) or there is a need to change price calculation (and marge). This needs additional internal approval.

Often time is under pressure, the selling person is very experienced in the company and he/she commits to price change with the customer before the company knows it. Salesperson know this is an acceptable level, he /she will be able to get approval for this.

Nothing wrong with it. I have seen this many times.

The issue is the following. We not always can see new prices (and deal marge) in calculation being CFO, managing partner. Official price calculations are corrected much later. And the marge is probably lower than company minimal plan.

Here are the business questions:

- What is (typical) marge for offers we produced last month?

- What is a marge of the offers we closed a deal with customers last month?

- How many offers we closed deal are below expected marge last months?

- Is there a pattern in animalities above?

Many CFO and managing partners know answers, but many not. All would admit it is important for business.

Final Conclusion

Understanding the basics of our presales process, beyond the budget spend is key to improve the effectiveness of it.

This may not increase the presales budget but should provide more value out of the same budget.

Respectively may provide better utilization and lower cost rates and finally more profit from the same resources.

What to do, to be able to answer the above questions? Simply it is a matter of visibility and having one version of truth repository of our offers which can be analyzed against the questions.

Pricell.io application is a solution to provide a 'one-stop' view on all pricing activities.

Not only it unifies the way how pricing is done but provides an integrated view on those presales